how does capital gains tax work in florida

Filing and paying Florida capital gains tax isnt necessary since Florida doesnt have state-specific rules. Ad A Tax Advisor Will Answer You Now.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

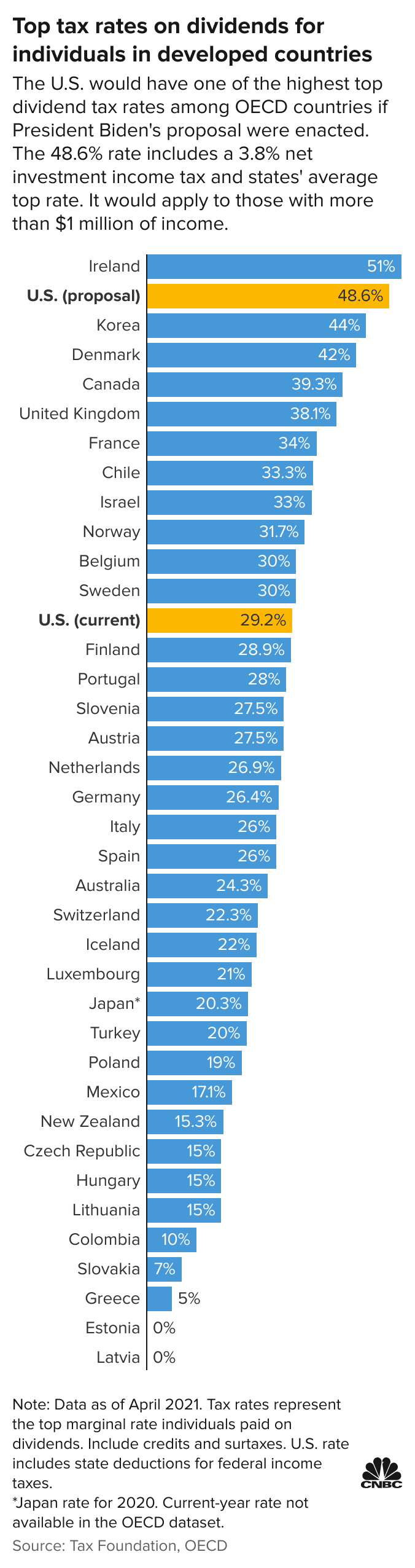

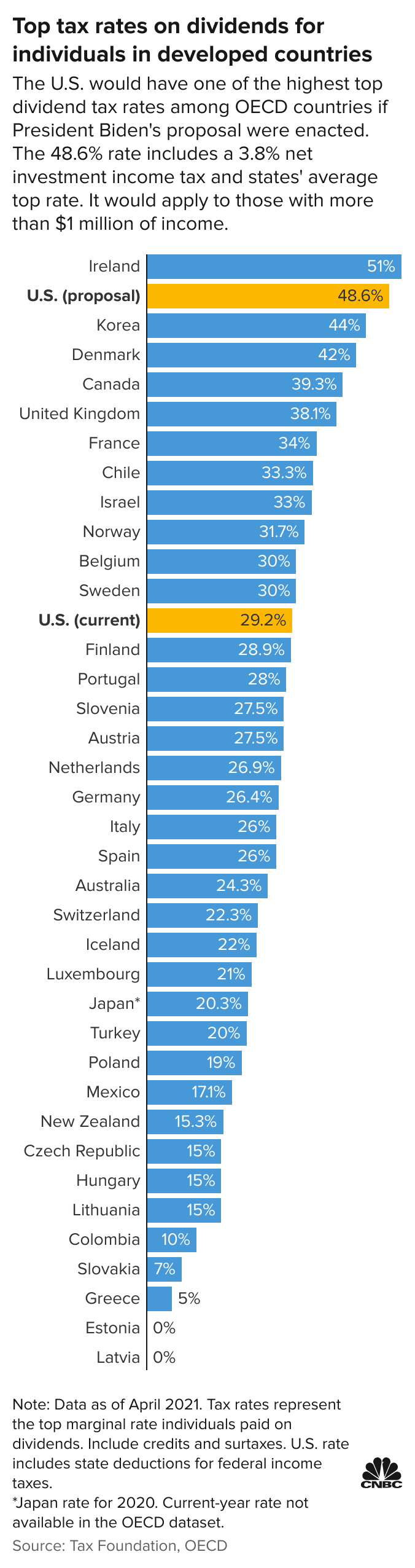

The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

. What You Need To Know 2022 1 day ago Aug 26 2022 A capital gains tax is a tax on the profit from the sale of an asset. Potentially pay 0 in Capital Gains. Florida does not assess a state income tax and as such does not assess a state capital gains tax.

Any money earned from investments will be subject to the federal capital. Get more tips here. 4 hours agoAccording to the IRS.

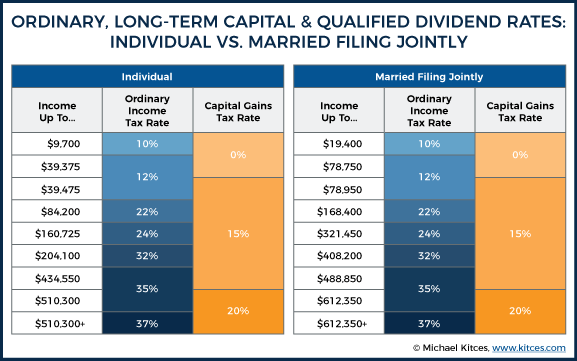

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The most common asset that is taxed. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning.

Obtaining the amount requires you to make adjustments including acquisition and. Ad Learn about Opportunity Zones. Connecticuts capital gains tax is 699.

Taxes capital gains as income and the rate reaches. Potentially pay 0 in Capital Gains. Capital gains taxes apply to the sale of stocks real estate mutual funds and other capital assets.

The seller makes short-term capital gain when shares are sold at a price higher than the purchase price. Short-term capital gains are taxable at 15 per cent -- irrespective of the tax slab the. The tax is based on the profit you made the price you sold it for minus the price you paid.

Ad Understand The Implications Of A Move To Florida On Your Wealth Estate Plan. Download 99 Retirement Tips from Fisher Investments. Ad Learn about Opportunity Zones.

Any amount exceeding these numbers is taxed at 20 percent. The State of Florida does not have an income tax for. Your home is considered a short-term investment if you own it for less than a year before you sell it.

Ad The Leading Online Publisher of National and State-specific Legal Documents. We always remind sellers about the Capital Gains tax and recommend they consult their accountant to figure out their capital gains liabilities long before the closing date because. For example if you bought a home 10 years ago for 200000 and sold it today for 800000 youd make 600000.

Questions Answered Every 9 Seconds. Get Access to the Largest Online Library of Legal Forms for Any State. Urban catalyst is a leader in Opportunity Zone investing.

However you must send federal capital gains tax payments to the IRS. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. Complete IRS Tax Forms Online or Print Government Tax Documents.

Taxes capital gains as income and the rate reaches 660. Florida does not have state or local capital gains taxes. Ad Tip 40 could help you better understand your retirement income taxes.

500000 of capital gains on real estate if youre married and filing jointly. Urban catalyst is a leader in Opportunity Zone investing. The capital gains tax is calculated on the profit made from the real estate sale minus expenses and the applicable capital gains tax will depend on who holds the title.

In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis. Florida Capital Gains Taxes. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations.

If you earn money from investments youll still be. Learn About Floridas Tax Landscape Homestead Laws Property Taxes More. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if.

Capital Gains Tax What Is It When Do You Pay It

Florida Real Estate Taxes What You Need To Know

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

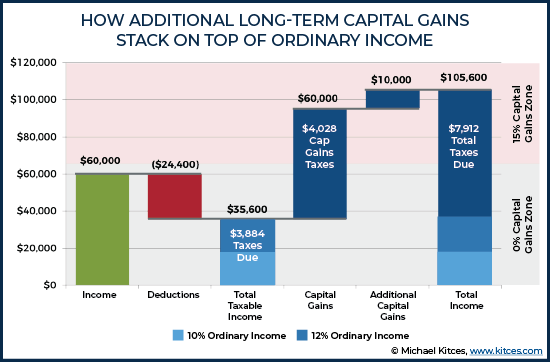

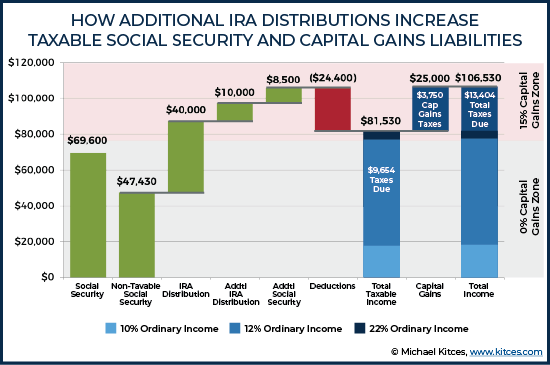

The Tax Impact Of The Long Term Capital Gains Bump Zone

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The Tax Impact Of The Long Term Capital Gains Bump Zone

State Taxes On Capital Gains Center On Budget And Policy Priorities

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

How To Pay 0 Capital Gains Taxes With A Six Figure Income

The Tax Impact Of The Long Term Capital Gains Bump Zone

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How To Calculate Capital Gains Tax H R Block

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube